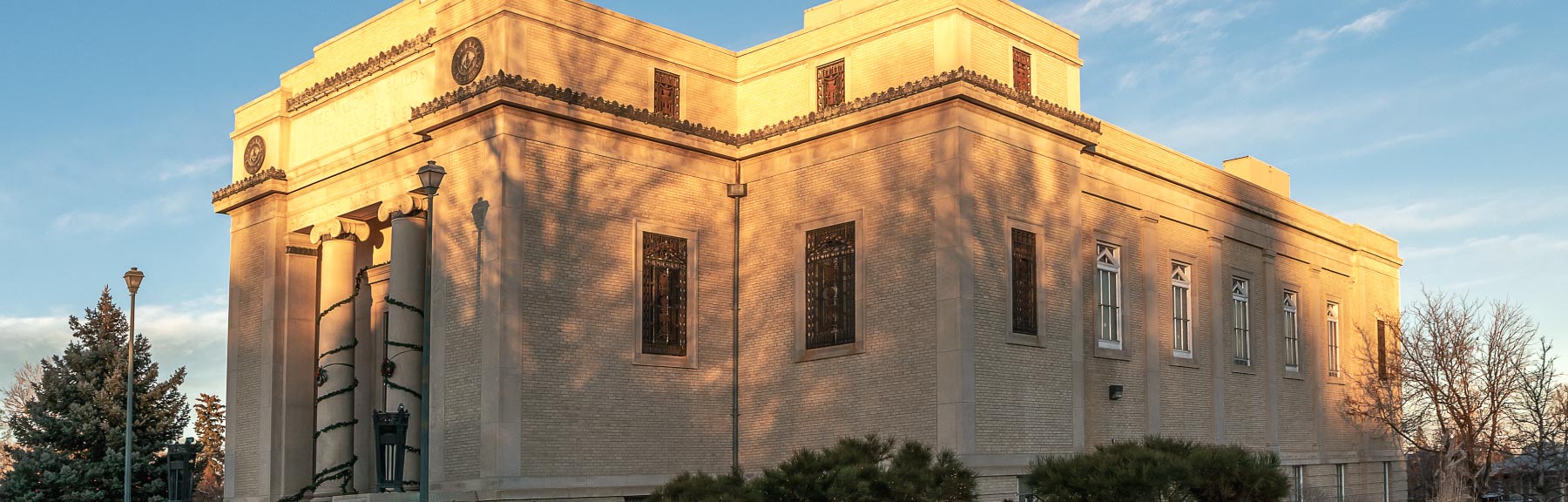

Valbridge appraisers evaluate commercial property based on objective criteria, in-depth knowledge of local property markets, and time-tested judgment. We identify and analyze the variables that affect value, often seeing what others don’t see based on our expertise and independence.

Valbridge appraisers evaluate commercial property based on objective criteria, in-depth knowledge of local property markets and time-tested judgment. We identify and analyze the variables that affect value, often seeing what others don’t see based on our expertise and independence.

In our industry, some service providers (including many brokerage firms) have an angle. They want clients to buy or sell, or borrow or lend, because their companies get paid for facilitating transactions.

We’re different from the competition.

INDEPENDENT VALUATIONS

We provide independent valuations and advise clients on real estate investment decisions. Second, the leading appraisers who manage our offices also are shareholders in the company.

COLLECTIVE STRENGTH

Clients across the U.S. benefit from the collective strength of North America’s largest independent commercial valuation firm, and our dedication to elevating appraisal industry standards for accuracy, integrity, reporting, technology and data.

POWERFUL INSIGHTS

Valbridge professionals can’t tell the future, but we’re trusted by clients to provide independent valuations and powerful insights for better business.

The Power of Blue

WHAT WE DO

Selected Assignments

SELECTED CLIENTS

Clients work with Valbridge on a local, regional or national basis: