The Tax Cuts and Jobs Act of 2017 offers investors tax incentives for economic development and job creation in low-income areas. These incentives are manifest in the ability to defer recognizing recent capital gains for federal income tax purposes and potentially eliminate any federal capital gains tax liability generated from investments in an opportunity fund.

Background

Opportunity Zones (OZ) were designated by state and local government agencies, frequently at the behest of the governors in early 2018. At the end of the process, there were 8,762 total Opportunity Zones in the United States, including territories. Up to ¼ of any state’s census tracts were eligible for designation if the tract’s poverty rate exceeded 20% and the median income did not exceed 80% of the metro or state level. The one exception was Puerto Rico, where 98% of the island has been designated an Opportunity Zone. The markets with the highest number of OZ’s are New York, Los Angeles, Chicago and Houston. For scale, New York City has 300 areas designated as Opportunity Zones and the Houston area has 150.

Details

The program works like this: Anyone who has realized capital gains from an investment can defer tax payment on the gains by placing the gains in a Qualified Opportunity Fund (QOF) within 180 days. These funds can be partnerships (LLC’s) or corporations and are self-certifying with the IRS. To date, there are more than 230 funds registered with more added each day. There is no minimum or maximum amount required in the funds, but they are required to invest at least 90% of their investment dollars into the businesses or properties located in an Opportunity Zone. The capital gains can come from any type of investment: stocks, business, real estate, etc. and do not have to be re-invested in the same asset class, unlike programs like the 1031 exchange. In addition, the program can be combined with other incentive program benefits such as the Low Income Housing Tax Credit program.

Timing is important as the clock starts ticking as soon as the capital gains are realized, making the setting up of funds and the identification of potential projects important to investors. The invested deferred gains are set to be taxed by the end of 2026, or when the asset is sold, whichever is sooner.

Investment benefits equate to not only deferral of taxes owed, but the potential for reduction or elimination in gains realized through the QOF. For example, if an asset is held for a minimum of 5 years, there is a 10% exclusion on the amount owed. If held for 7 years, the exclusion expands to 15%, and if the asset is held for 10 or more years, all capital gains earned on the appreciation of the investment are excluded from liability.

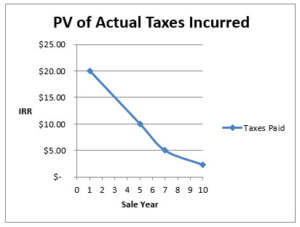

To illustrate, imagine that an individual has realized a $100 capital gain from a stock investment. Ordinarily, that gain would be taxed at 20% for a net gain of $80. Under the Opportunity Zone program, the individual can instead take the $100 capital gain and place it in a Qualified Opportunity Fund (QOF) within 180 days of the sale. Taxes on the deferred gains then would be due at the time of sale of the OZ investment or the end of 2026, whichever comes sooner.

If the investment is held for at least 10 years, and the investment grows at an assumed rate of 8%, the value then would be $215.89 and the capital gains would equate to $115.89. The tax due on the original capital gain of $20 has been reduced by 15% because it was held for at least 7 years, and is now a $17 liability.

If we assume an 8% discount rate, that $17 liability for the 2026 tax year is approximately $9.18 at the end of 2018 in net present value terms, or roughly 46% of the taxes otherwise due. The deferral, combined with the 15% reduction, reduces net present tax liability by over half.

What’s more, the $115.89 capital gain from the OZ investment would be tax free because it was held for 10 years, adding $23.18 in savings. In total, the savings would be $26.18 ($3.00 from the original capital gains and $23.18 from the 10-year OZ investment gains.) The effective tax rate on the total OZ appreciation of $215.89 ($100 from the original investment and $115.89 from the 10-year hold gains) is 7.9%.

To Qualify

The tax exclusions trigger not just by timing, but in the results of the OZ investment made through the QOF. For example, if the fund invests in a pre-existing building in an Opportunity Zone, the building has to be “substantially improved” to qualify for benefits. This metric is based on the adjusted basis in the building only, and excludes any value attributed to the land. This detail makes it critical to establish land and building allocations through third party valuations.

“Substantially improved” is defined by investing at least as much on the improvements as was paid for the asset originally, so if an investor purchases a property for $100,000, of which $50,000 was attributed to the building, they must show that at least $50,001 was spent on the renovation/rehab of the property. Vacant land will likely need to be developed with new improvements that are used actively in a trade or business directly or indirectly owned by a QOF in order to meet the “substantial improvement” test, and the renovations must be completed within a 30-month period beginning at the date of acquisition. In addition, the investor must demonstrate the property or business owned is at least 70% located in an Opportunity Zone to qualify for benefits.

Exclusions to the program are few and include non-arm’s length transactions, golf courses, massage parlors, hot tub facilities, suntan facilities, racetracks and other gambling facilities, and liquor stores.

Potential Impact

Premiums in real estate pricing are anticipated in OZ locations in attractive areas as investors learn the program and its advantages. According to Costar, hotel property sales within the zones increased by 51% in 2018, in contrast to the 31% rise outside of the zones.

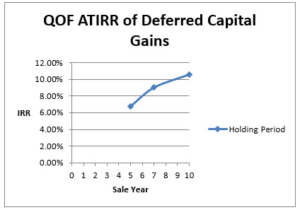

Different analyses of the program’s impact have shown variations in results, but all are demonstrating a positive effect for investors. One report showed annual rates of return as much as 3% higher in an OZ versus a non-OZ property of identical characteristics, and a cap rate difference of 24 basis points compared to an identical 1031 transaction.

According to the Mortgage Bankers Association, OZ program tax benefits can add between 150 and 300 basis points to after-tax IRR’s. The tax deferral effects alone can be further multiplied using leverage to finance the investment project. This incentive could have additional effects on the amount and contractual terms of debt financing agreements, as well as price effects on property in Opportunity Zones.

Questions Remain

As details are still emerging and clauses are being clarified, investors and other stakeholders still have questions about the program. Will the impact be long-term? Will residents in the zones gain employment opportunities? Will the zones accelerate gentrification and drive out existing residents? How will the effectiveness of the program be measured?

Specific details can be answered by engaging the right advisors and professionals. For example, when determining the allocation of land and improvements for reporting purposes, the investor would be wise to submit a third-party appraisal which breaks out the values. Similarly, funds will need appraisals to prove the “90% test” as the ratios on reporting dates will be critical. Finding an appraiser with expertise and program knowledge will be the key to fully realizing the benefits of the program.

Useful Resources

For Frequently Asked Questions: https://taxfoundation.org/opportunity-zones-what-we-know-and-what-we-dont/#_ftn9

For IRS Clarity: https://www.irs.gov/newsroom/opportunity-zones-frequently-asked-questions

To See an Interactive Map of Opportunity Zones: https://www.enterprisecommunity.org/opportunity360/opportunity-zone-eligibility-tool

by:

Michele Wood

Director of Research

Valbridge Property Advisors | Houston

Valbridge Property Advisors is the largest independent Commercial Valuation Company in North America with over 70 offices throughout the Country.