Ryan Cloern

Senior Managing Director

Valbridge Property Advisors | Louisville | Cincinnati | Lexington

In the ongoing struggle to address the pressing issue of affordable housing in the United States, the Low-Income Housing Tax Credit (LIHTC) program has become a vital tool. Enacted as part of the Tax Reform Act of 1986, the LIHTC program is structured so that a public-private partnership is formed, leveraging the ingenuity and expertise of the private sector with resources from the public sector. The result is the development of thousands of quality affordable rental units aimed at reducing the housing shortage in the US.

The LIHTC program operates by providing tax credits to developers who invest in affordable housing projects. The credits are allocated by state housing agencies based on a rigorous and competitive application process. Once awarded, developers sell the tax credits to investors, usually large financial institutions, generating equity for their projects and offsetting a significant portion of the construction cost. Once built, the development is legally restricted to affordable housing (typically households earning between 30% and 80% AMI) for up to 30 years.

The How and Why of the Importance of LIHTC in Providing Quality Affordable Housing

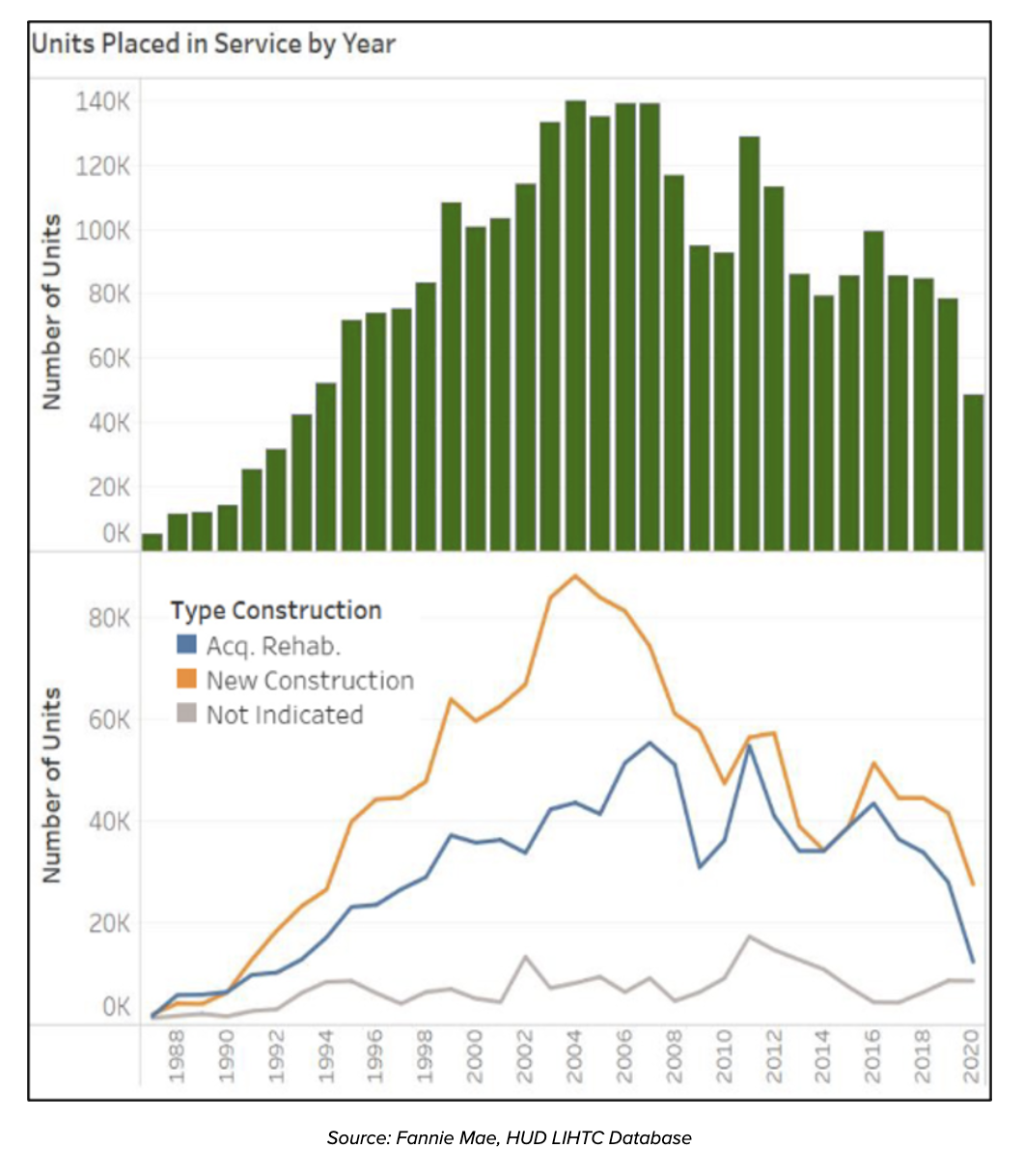

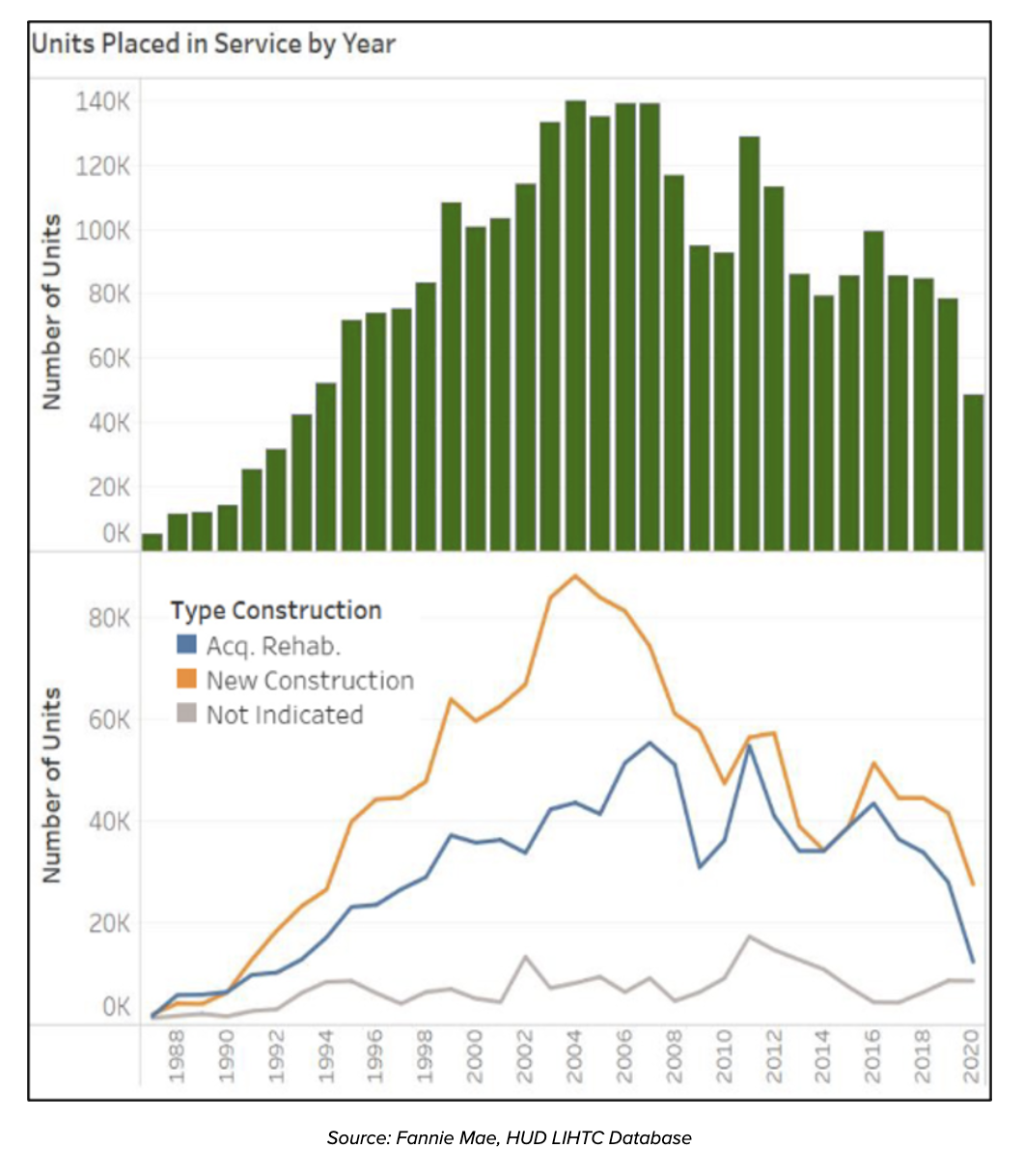

- Increasing Housing Stock for the Vulnerable Population: One of the primary contributions of LIHTC properties is the expansion of affordable housing options for low-income individuals and families. By incentivizing private investment, the LIHTC program has significantly increased the overall supply of affordable rental units. The tables below, which are based on information taken from the HUD LIHTC Database, indicate peak years for unit delivery occurred between 2004 and 2007 with nearly 140,000 units annually, most of which were new construction. According to the US Census Survey of Construction (2023), annual LIHTC delivery accounts for roughly 20% of all new multifamily units nationwide. The LIHTC program not only helps address the immediate housing needs of vulnerable populations, but also contributes to the stabilization of communities by providing a more balanced housing market.

- Neighborhood Revitalization: LIHTC properties often play a pivotal role in the revitalization of distressed neighborhoods. By encouraging the development of affordable housing in economically depressed areas, the program often brings additional public / private investment to the community in the form of improved infrastructure, commercial and recreational amenities, and additional job opportunities, all of which improve the neighborhood and its residents.

- Diversified Housing Options and Demographics: LIHTC properties typically include apartment complexes or single-family homes. However, the housing options can be tailored to accommodate any number of unique demographics including families, seniors, and individuals with special needs. More recently, housing agencies have set aside tax credit allocations for developments that target homelessness, individuals with mental illness, or people who battle addiction.

- Long-term Affordability: LIHTC properties are subject to strict regulatory agreements that mandate rent and income restrictions for a specific period, typically 30 years. This helps ensure the long-term affordability of these units, safeguarding against market fluctuations that might otherwise render affordable housing unattainable for low-income households. This is particularly relevant in today’s economic environment where multifamily rents have seen YoY increases of more than 10% in many markets across the county. The program’s commitment to enduring affordability underscores its effectiveness in providing stable and secure housing options for those in need.

- Public-Private Partnerships: The LIHTC program fosters collaboration between the public and private sectors. Developers, investors, and government agencies work in tandem, each contributing unique strengths to the affordable housing ecosystem. This collaborative approach not only maximizes the impact of available resources, but also encourages innovation in design, construction, and management of affordable housing developments.

- Increasing Housing Stock for the Vulnerable Population: One of the primary contributions of LIHTC properties is the expansion of affordable housing options for low-income individuals and families. By incentivizing private investment, the LIHTC program has significantly increased the overall supply of affordable rental units. The tables below, which are based on information taken from the HUD LIHTC Database, indicate peak years for unit delivery occurred between 2004 and 2007 with nearly 140,000 units annually, most of which were new construction. According to the US Census Survey of Construction (2023), annual LIHTC delivery accounts for roughly 20% of all new multifamily units nationwide. The LIHTC program not only helps address the immediate housing needs of vulnerable populations, but also contributes to the stabilization of communities by providing a more balanced housing market.

- Neighborhood Revitalization: LIHTC properties often play a pivotal role in the revitalization of distressed neighborhoods. By encouraging the development of affordable housing in economically depressed areas, the program often brings additional public / private investment to the community in the form of improved infrastructure, commercial and recreational amenities, and additional job opportunities, all of which improve the neighborhood and its residents.

- Diversified Housing Options and Demographics: LIHTC properties typically include apartment complexes or single-family homes. However, the housing options can be tailored to accommodate any number of unique demographics including families, seniors, and individuals with special needs. More recently, housing agencies have set aside tax credit allocations for developments that target homelessness, individuals with mental illness, or people who battle addiction.

- Long-term Affordability: LIHTC properties are subject to strict regulatory agreements that mandate rent and income restrictions for a specific period, typically 30 years. This helps ensure the long-term affordability of these units, safeguarding against market fluctuations that might otherwise render affordable housing unattainable for low-income households. This is particularly relevant in today’s economic environment where multifamily rents have seen YoY increases of more than 10% in many markets across the county. The program’s commitment to enduring affordability underscores its effectiveness in providing stable and secure housing options for those in need.

- Public-Private Partnerships: The LIHTC program fosters collaboration between the public and private sectors. Developers, investors, and government agencies work in tandem, each contributing unique strengths to the affordable housing ecosystem. This collaborative approach not only maximizes the impact of available resources, but also encourages innovation in design, construction, and management of affordable housing developments.

LIHTC properties are appraised differently than market-rate properties, primarily due to unique financing structures and regulatory requirements associated with the LIHTC program. When appraising tax credit developments, appraisers must take into account all rent and income restrictions, along with the impact of any government subsidies on the property’s value. Appraisals for proposed LIHTC developments often include the value of the partnership interest (value of the tax credits) as well as the intangible value of any preferred financing, which many developers use to further reduce the debt structure of the project. These distinctive considerations make the appraisal of LIHTC properties a specialized and nuanced process compared to traditional market-rate properties.

In conclusion, the Low-Income Housing Tax Credit program is one of the country’s best resources in addressing the critical issue of housing availability and affordability in the United States. Through its innovative public-private partnership model, the LIHTC program has not only increased the supply of affordable housing, but has also promoted community development, aided neighborhood revitalization, and encouraged the private sector to engage in meaningful solutions. As the nation continues to grapple with the challenges of housing insecurity, the LIHTC program remains a vital tool in the quest to ensure that all Americans, regardless of income, have access to safe, quality, and affordable housing.