By: Michele Wood, Director of Research, Valbridge Property Advisors | Houston

November 19, 2020

As we move to the end of what has been a dramatic, traumatic and unexpected year, we have been hearing lots of talk of the alphabetic nature of the economy. When things suddenly collapsed in late March, there was much talk of the optimistic “V” shaped recovery. Some predicted a “W” shape with more volatility built in before recovery. Pessimists suggested a prolonged “L” shape with recovery too long off to even see on the graph. What has recently emerged in the headlines, however, is a somewhat rare letter to be invoked when talking about economic graphing: the “K”-shaped recovery.

What is a K-shaped recovery anyway?

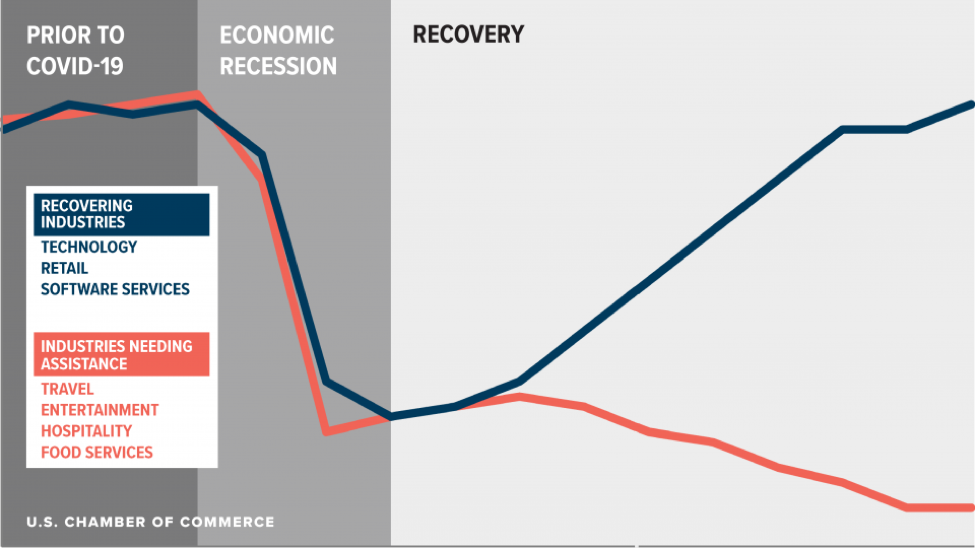

A K-shaped recovery is when, following an economic recession, parts of the economy recover at different rates, times, or magnitudes. A K-shaped recovery generally leads to structural changes in the economy as outcomes on relations are fundamentally changed.” In the graph above, we can see the emergence of the K-shape in predictions represented by different industries. Another example of K-shaped fortunes can be seen in this data:

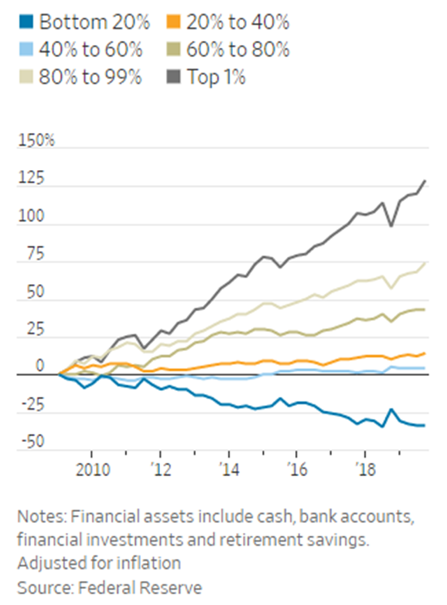

Change in Financial Assets Since Last Recession by Household Income Group

The diverging lines creating the K-shape indicate uneven fortunes resulting from the impact of COVID-19.

At the nadir of unemployment in April, the proportion of Americans 25-54 years old that had jobs fell below 70% for the first time in almost 50 years. In June, the IMF predicted that 89 million people will be pushed into extreme poverty around the world. Twenty million jobs were lost in the United States in the spring. Many workers went back over the summer, but we are now seeing an uptick in the number of permanent layoffs. Disney, LinkedIn, major airlines and cinema companies are all shedding thousands of jobs.

The 21st century has been marked by three main economic shocks: the integration of China into the world economy, the financial crisis of 2007-2009, and the rise of the digital economy.

When China joined the WTF in 2001, the growth in manufacturing resulting from poor farmers moving to large cities for factory jobs helped create low inflation and cost the rich world jobs. The financial crisis depressed demands and lowered interest rates further. The rise in the digital world has created a decline in competition, record corporate profits and the fall of income to workers.

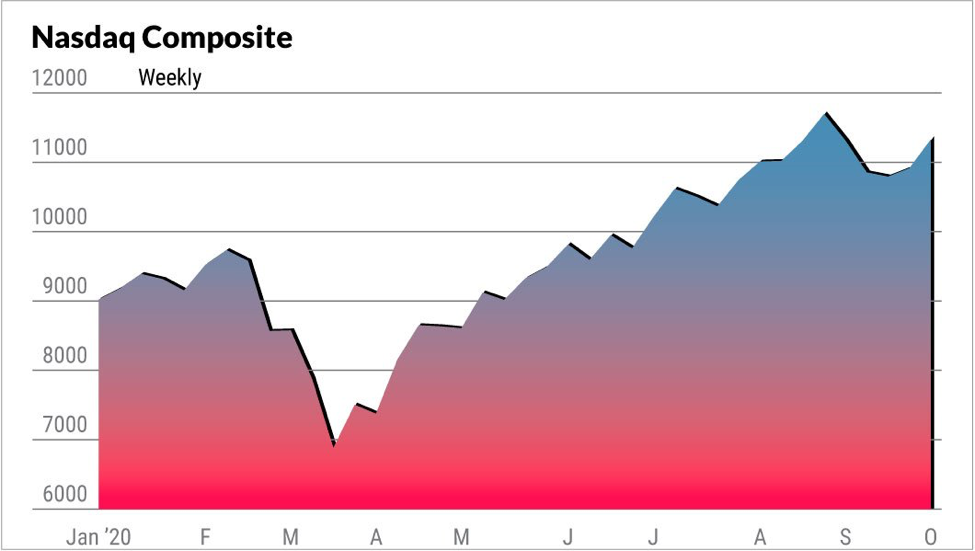

These shocks over the past 20 years, and their ensuing recoveries, have laid the foundations of increasing wealth disparity, particularly in the United States. As lower wage workers lose jobs and prospects, highly skilled and high-income Americans with assets are seeing windfalls as their homes gain value and the stock market climbs. According to Redfin, the median home price increased 15% year over year during the four-week period ending October 4. Indices like the Nasdaq are now at higher levels than they were at the beginning of the year.

Right now, only 19% of total American layoffs since March have been reported as permanent, but a recent paper by Stanford researchers predicts at least 33% of jobs lost will never return. The stimulus program of sending $1,200 checks to individuals, along with an additional $500 per child add-on, plus the $600 per week unemployment insurance benefit from the federal government this year kept many low income households afloat, and even better off in some cases. In August, consumer spending in low-income zip codes was barely lower than it had been in January.

Many companies are pulling in lower sales and must make do with reduced staff to stay in the black (or at least not as deep in the red.) Major restructuring is happening with firms re-thinking their operations and efficiencies. Many are seeking to simplify in every way. Automation is now being fast-tracked into operations. While this will lead to more tech jobs in the future, it is decimating the old-fashioned jobs now.

In all the anxiety and gloom, however, there is reason for hope. Disruption can be positive. The idea of “creative destruction” is most often associated with the Austrian economist Joseph Schumpeter, who described the idea as “a process of industrial mutation that continuously revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” The revolutionary thinker and mathematical statistician Nassim Nicholas Taleb expanded on the ideas of creativity emerging out of destruction in his book Antifragile. To Taleb, “Some things benefit from shocks; they thrive and grow when exposed to volatility, randomness, disorder, and stressors and love adventure, risk, and uncertainty.”

The move away from cities by many workers has loosened the prohibitive cost of living for those in dense job-rich urban locations. The need for people to gather in certain high-cost cities acted as a barrier to success for low-income workers as too much of their pay was absorbed by housing costs and ever-increasing medical costs. San Francisco rents for 1-bedroom apartments have dropped by 20.7% over this year, according to Zumper. New York City rents are down 15%.

In addition, the ability of some lower-income workers to relocate outside of crowded, expensive cities now opens up the possibility of home ownership, especially as interest rates remain low. This will help bridge the wealth divide in time as some renters become owners.

The move to online work for everyone, including administrative and support staff and service workers may also help firms find and keep top talent, since location is not a barrier any longer. This will foster company growth.

Entrepreneurship is on the rise in America as well. “High propensity” business applications — those displaying characteristics typically associated with firm creation and the employment of staff — reached the highest quarterly level on record after Q2 this year. Goldman Sachs reported that the share of new business in the 3 months leading into October had risen sharply. As described in the October 10 edition of the Economist, “The fact that America has suddenly recovered its entrepreneurial mojo is particularly intriguing, since nothing comparable seems to be happening elsewhere in the rich world.”

This boom is very different from the last recession, where the rate of new business creation plummeted. One possible reason for the phenomenon is that the stimulus provided by the feds did little to protect jobs, but instead gave some people the income protection sufficient to start a business while at the same time creating the need to, as their jobs had disappeared. In the past year, the number of sole proprietors working in the information sector (data processing, web-search portals, and publishing) has gone up by 50%.

To keep the trend lines going up and to close the gap between those recovering and those falling farther behind, more stimulus needs to be directed at keeping individuals and families out of poverty. Without it the gap could drastically increase.

The trends were already in the wrong direction in income and wealth disparity, so any intervention must bridge the way to the new economic order- Entrepreneurial mojo is truly a tide that lifts all boats.