COVID-19 and Commercial Real Estate

June 19, 2020

2020 SPECIAL REPORT

IMPACT OF COVID-19 ON COMMERCIAL REAL ESTATE

As the COVID-19 pandemic continues to cause unprecedented impact in every sector of the American economy. The impact on commercial real estate is already substantial, and will almost certainly be profound. This report is a guide to major trends as well as sector by sector analysis and reporting designed to help inform and guide your decision making in the coming months.

IN THIS ARTICLE:

• Major trends for your consideration

• Select sector analysis: hospitality, retail, and office

• Read more & additional resources

MAJOR TRENDS

It’s become a truism of 2020 that this year’s events are unprecedented. From public health to schools and hospitals and public spaces to individual decision-making, every inch of our lives feels the impact of the COVID-19 epidemic. Certainly, this is true in the commercial real estate market as well.

While the pandemic continues to grow and change, no one metric will predict with any certainty how coronavirus will impact our economy. Financial markets are seeing dramatic impacts and sizable swings, and unpredictability seems to be a new normal. However, there are some measures and observable trends that we can examine, in an effort to understand how this economic crisis is similar to – and different from – previous ones.

One major differential is that the circumstances around COVID-19 have dealt shocks to both the supply and the demand side. Commercial real estate markets are already reporting drops in transaction volumes due to travel restrictions, stay at home orders, changes in business models, and anxiety about the future.

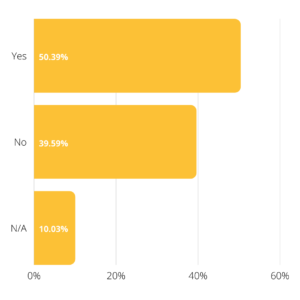

Have you observed pending sales terminated or renegotiated due to COVID-19?

An April 2020 survey conducted by Valbridge Property Advisors, reported that more than half of respondents had observed pending sales terminated or postponed due to COVID-19.

Alongside market volatility, the pandemic has introduced a variety of behavioral changes to American life that seem likely to outlast the outbreak. For example, one report by McKinsey & Company predicts that, at an individual scale, consumers who have moved to online shopping due to closed malls and retail areas may shift their buying habits permanently, accelerating a trend that was already in play pre-pandemic. A shift to e-commerce might also boost (already high) demands for industrial space. Some sectors – like self-storage or cloud kitchens – could see large improvements in their unit economics, while others – like co-working or co-living spaces – might see substantial declines.

While predicting the specifics of transformative change is impossible, it seems clear that one trend to keep firmly front-of-mind is this: behavioral changes will drive commercial real estate changes. As in the 2008 global financial crisis, some real estate players will flourish and others will fail. Individual firms and owners’ abilities to weather this storm and to emerge in a solid position will depend largely on how they respond to short and medium term challenges.

In the short term, cash flow management will be key. It is typical for real estate to function in a decentralized way, with decisions often made at the property level. Because those decisions impact cash flow, however, it will be increasingly important to coordinate property-level cash management with company-level balance sheet decisions, credit lines, and loans (including potential state or federal assistance).

Creativity will also be the mark of successful operators, since cutting costs are not the only way to create cash. Some residential developers, for example, are finding creative ways to move new inventory, including lease-to-own programs,

financing partnerships, and other less conventional solutions.

Of course, not all real estate assets are performing the same way during the crisis. The market seems to have pivoted mostly on the inherent degree of physical proximity among an asset class’s users—even more so than on its lease length. Assets with greater human density – healthcare facilities, regional malls, lodging, and student housing – seem to have been the hardest hit and have sold off considerably. On the other hand, self-storage facilities, industrial facilities, and data centers have faced less-significant declines.

How COVID-19 is Impacting CRE Fundamentals and Operations

In the Los Angeles and Inland Empire, with our high degree of population density, these factors will be particularly important to bear in mind. As of April 3, by one estimate, the unlevered enterprise value of real estate assets had fallen 25 percent or more in most sectors and as much as 37 percent for lodging (the most extreme example).

For these reasons, understanding how different sectors of the commercial real estate market are responding to the impact of the pandemic will be essential for wise and strategic decision-making over the coming months. Let’s examine a few – hospitality, industrial, retail, and office space – each of which are performing in unique ways due to the challenges and characteristics specific to each asset class.

SECTOR ANALYSIS: HOSPITALITY

During past decade, the hospitality sector in the US has experienced unprecedented growth. The nation’s average RevPAR (revenue per available room rate, a metric calculated by multiplying a hotel’s ADR, or average daily room rate, by its average occupancy rate) improved 64 percent between the end of the last downturn and the beginning of 2020. Occupancy achieved a record high of 66.3 percent in 2018 and 2019.

Of course, travel restrictions and stay at home orders have halted that trend. RevPAR has dropped a comparable amount, down to roughly a third of its value from 12 months prior. Some hoteliers have already begun to suspend operations and furlough employees until conditions improve, and some companies that are suddenly in higher demand, like grocers, have begun to work with hotel companies to meet short-term staffing needs.

The same precautions that have stymied travel are also limiting the availability of labor and raw materials for hotel construction. At the start of the year, the total number of hotel room nights was expected to grow by more than 2 percent: certainly that projection is no longer relevant or applicable. Properties currently under construction will face delays and projects set to be break ground may be reconsidered.

However, behavioral changes are again a critical factor. If unemployment remains fairly low and/or rebounds relatively quickly, and the number of coronavirus cases abates, people may immediately want to travel again, spurred by cabin fever and rescheduled events. Room-night sales lost in the second and third quarters could potentially be recovered in part in late 2020 to help restore hotels to normal operations. On the other hand, if state and local restrictions on travel increase, or remain in flux or in direct conflict, the remainder of 2020 is likely to see a substantial downturn across the sector.

Hotels in different areas will also perform differently. Those in or near larger urban areas will be disproportionately affected, and business closures in cities will delay hotel recovery. Similarly, airport-adjacent hotels will be severely impacted, and bans on international travel will continue to impact those near major hubs.

Conversely, hotels along major roadways have fared better (RevPAR for this group during the week of March 21 fell by the smallest amount of any sector), since some people are still traveling either out of necessity or by choice, and this group will almost certainly be among the first and fastest to recover.

SECTOR ANALYSIS: RETAIL

In recent years, shopping centers have struggled to succeed, as foot traffic has decreased, vacancies have increased, and consumer shopping habits have shifted to online purchasing. As we emerge from this pandemic, it is anticipated some shopping centers will face bankruptcies, closures, and e-commerce will continue to grow and take a greater piece of the pie.

However, as with hospitality, some retailers are in better positions than others, and therefore shopping centers with these tenants will likely not be affected.

• Higher-end goods retailers like Nike, Apple, and Lululemon have their inventory in an ideal place to survive a pandemic.

• Retailers like Dick’s Sporting Goods, Target, and Walmart, have robust omni channel capabilities to weather the coronavirus pandemic.

• Retailers in a worse position include those that were struggling before the pandemic, like Macy’s, Sears, Forever 21, Pier 1 Imports, and Gap. Since they were already facing financial challenges due to declining sales, they will almost certainly be forced to close more stores.

As of mid-March, Coresight Research expected 15,000 stores to close permanently in 2020, a number will prove a low estimate, as the pandemic stretches into late summer and autumn.

As shopping centers have struggled, department stores have closed, leaving owners with large gaps. One successful solution previously has been to fill those gaps with experiential tenants – replacing a former J.C. Penney’s, for example, with a 24 Hour Fitness or a movie theatre or a children’s play center.

As the impacts of coronavirus drive more retail spaces out of shopping centers, it could accelerate those vacancies. But how will experiential tenants – who rely on the close proximity of large numbers of people – fare in a post-pandemic world? It remains to be seen how social-distancing will impact the retail environment as these concepts are currently vulnerable.

Movie theaters, which anchor many shopping centers across the country, have already been threatened

by streaming services, and retail experts foresee a drop in demand. Furthermore, fitness centers, which many shopping center owners have looked to fill the vacancy, have also become vulnerable to the pandemic.

On the other hand, open-air shopping centers, neighborhood centers, and community centers, many of which are anchored by highly productive grocers, drug stores, or home improvement chains, are proven essential during the pandemic.

Many consumers have rediscovered the grocery store anchoring their neighborhood shopping center after finding online sources to be unreliable, and warehouse club retailers full of panicked shoppers stockpiling. Early spikes in grocery traffic seem to have smoothed out by mid-summer, and retailers have adjusted their supply chains and delivery models, offering senior-only shopping, expanded online delivery, and curbside pickup.

U.S. online grocery sales hit $7.2 billion in June, up 9% month-over-month but less than the big double-digit gains seen in April and May, according to the Brick Meets Click/Mercatus Grocery Survey.

The growth of online orders seems on track to continue growing, if in a less dramatic way than it did in the spring: a June 2020 survey indicated that interest in receiving an online grocery order via pickup or delivery rebounded slightly, with 32% of all households (active online grocery shoppers or not) being extremely or very likely to use a service within the next 90 days, up two percentage points from May. By contrast, data from NetElixir showed that online food sales between March 1-March 25 surged by 183% versus the same period in 2019.

It seems likely that grocery-anchored shopping centers will continue to fare well, especially those who can accommodate shoppers’ desire for online ordering and delivery options. Unfortunately, unanachored centers, like strop malls, typically experience the most distress during economic downturns, because small service-oriented tenants tend to be undercapitalized. This seems like to prove true in this economic crisis as well. Grocery anchors will prosper, while restaurants and side shops will struggle, and side-shop tenants will suffer serious cash-flow stress.

The length of the pandemic, and the extent of retail closures, will vary by location, but undercapitalized tenants and undercapitalized landlords are landlords alike are unlikely to survive, particularly if the third quarter of 2020 is similar to the first two in terms of public health responses.

SECTOR ANALYSIS: OFFICE

Again, behavioral changes will be critical in determining the effects on office spaces. Within commercial office space, the multiyear trend toward densification and open-plan layouts may reverse sharply. Public-health officials may increasingly amend building codes to limit the risk of future pandemics, potentially affecting standards for HVAC, square footage per person, and amount of enclosed space. As many previously struggling brands are tipped over the edge into bankruptcy or forced to radically reduce their footprint, the market may become oversaturated. Early evidence from China shows staying power in the coronavirus-driven shift to

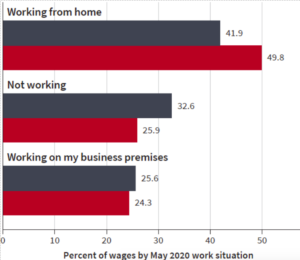

e-commerce. Furthermore, the shift to working from home (WFH) is likely to persist for many companies, as they discover what impact that model has on their bottom line. An incredible 42% of the US work force is now working from home, while another 33% are not working at all, testament to the crushing blows dealt to many industries by the pandemic. Only 26% of workers – mostly those deemed “essential” – are working at their places of business.

Of course, not every job nor every industry is suited to a work from home model, and so it is unlikely that the need for office space will evaporate entirely. Rather, companies are likely to adopt modified schedules to decrease density and to lower costs. As companies consider relocating from densely populated urban centers in the wake of the COVID-19 crisis, cities may suffer while suburbs and rural areas benefit.

WFH now accounts for over 60% of US economic activity

For office and retail properties, Moody’s predicts a protracted slump. They project office vacancy to peak at 21% in 2021 and remain close to 20% through 2024. (By comparison, retail, according to their models, will top out in 2021 at just under 15% vacancy and gradually improve to 11.5% by 2024). Net absorption is likely to drop precipitously in 2020 and 2021 in both office and retail sectors and begin to recover after that. It is, however, important to note that rents and vacancies in both office and retail are expected to track with GDP performance, so the model is sensitive to future changes in that metric.

CONCLUSIONS

It is clear that the impacts of the COVID-19 pandemic will resonate far beyond 2020, impacting economic activity, behavioral choices, and financial markets for years to come. Thus, the greatest two assets for commercial real estate going forward will surely be intangible ones: creativity and curiosity.

Remaining interested in and sensitive to the shifts in human behavior will be essential for success in the long term, while creative problem solving and thinking will be critical to remain solvent in the short term. It is clear that performance will vary substantially across sectors, by geography, and by capitalization; what is less clear is how policy changes at the state and federal level will either mitigate or intensify the impacts felt. Remaining informed will be critical, and we at Valbridge Property Advisors will strive to continue bringing you the latest and best commercial real estate market information in the months to come.