Direct to Consumer Brands & Commercial Retail Spaces

April 4, 2022

Read More:

ARTICLES

- Direct to Consumer Brands & Commercial Retail Spaces

- Adaptive Reuse: A Viable Strategy for Office Spaces?

- COVID-19 and Commercial Real Estate

- Right-of-Way Appraisals

- Tax Code Changes

- Assessing Risk to Commercial Properties

- Fair Market Rental Value in Commercially Leased Spaces: Appraisal Methods

MARKET INSIGHTS

- May 2022 Trends and Market Insights

- February 2022 Trends and Market Insights

- November 2021 Trends and Market Insights

- September 2021 Trends and Market Insights

QUARTERLY NEWSLETTERS

- 2Q2023: LA and Inland Empire

- 1Q2023: LA and Inland Empire

- 4Q2022: LA and Inland Empire

- 3Q2022: LA and Inland Empire

- 2Q 2022: LA and Inland Empire

- 1Q 2022: LA and Inland Empire

- 4Q 2021: LA and Inland Empire

- 3Q 2021: LA and Inland Empire

Keep up with our latest research and analysis! Articles are a deep dive into special topics. Market Insights round up the latest reporting trends and market movements for the region. Quarterly Newsletters present essential data, statistics, and analysis for every major CRE market sector in Los Angeles and the Inland Empire on a quarterly basis (drawn from CoStar data).

Contact Us

Matthew Lubawy, MAI, CVA

Senior Managing Director

Valbridge Property Advisors

LA@valbridge.com

(626) 486-9327

www.valbridge.com

From grocery delivery to Siri to Amazon, the internet has revolutionized our daily lives, our communication habits, and most of all, our shopping. Window shopping has transformed from something that happens on Main Street into a habit that lives on your phone screen, and the personal experience of speaking with a store attendant has become “add to cart” and the ease of a click-to-ship experience.

Where is retail happening? More and more the answer is: online.

The growth of e-commerce led some experts in a pre-COVID economy to predict that traditional brick and mortar retail was dying (the “retail apocalypse” was a common doom and gloom slogan). Certainly it is true that the pandemic took the growing retail e-commerce trend and supercharged it – in 2020, e-commerce retail sales rose 45% from 2019, as brick and mortar stores closed, some temporarily and others permanently. In 2021, as traditional spaces have re-opened, e-commerce has continued to grow, but at a less dramatic pace: up 17% year over year.

This trend will only continue: Forbes predicts that by 2025, online purchases will represent nearly a quarter of total retail sales.

But online wins haven’t been spread evenly. Since the early 2000s, while many traditional retailers struggled to get online, so-called “direct to consumer” (DTC) brands like Everlane or Dollar Shave Club proliferated across the web (often boasting that they “cut out the middleman”). These brands sell shoes, mattresses, razor blades, fashion, cookware, and more exclusively online, often to millennial and younger audiences.

But during the pandemic, even as e-commerce boomed, many DTC brands struggled.

A perfect storm for DTC brands

Why? Two overlapping factors have spelled disaster for DTC performance. The first reason has been the rise of customer acquisition costs and online overhead. Facebook and Instagram ad prices (the primary ad delivery mode for most DTC brands) have skyrocketed in recent years due to rising demand — and in some cases, contracting supply — leaving DTC companies in a bind. “In two years, it’s basically doubled to tripled,” said David Herrman, a social media ad buyer, of the cost to advertise on Facebook (CNBC).

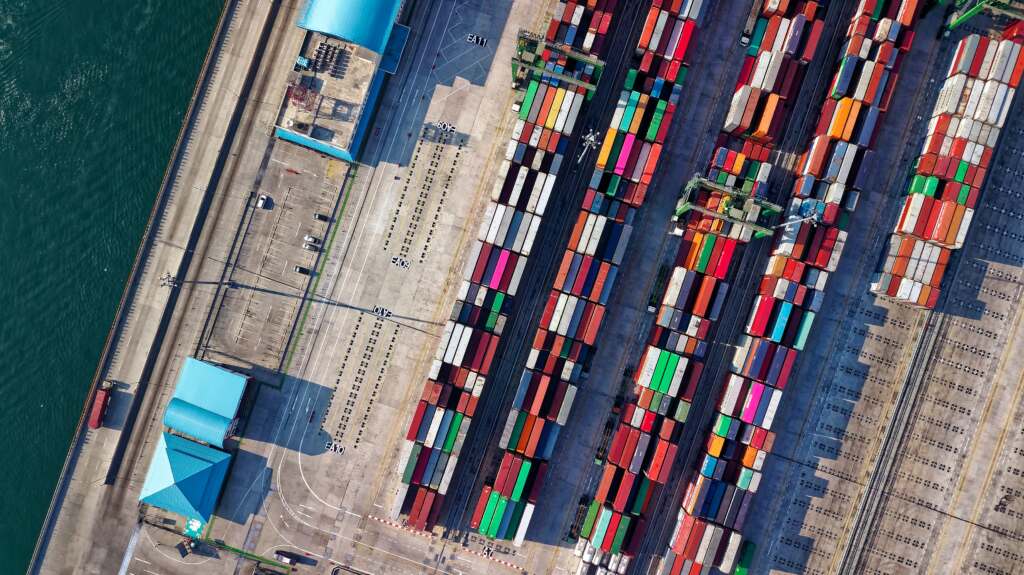

At the same time, the cost of container shipping from China has exploded: last May, shipping one container cost about $2000. It now costs north of $15,000 (via Big Technology). Nearly all DTC brands rely on cheap production costs and until recently, could take advantage of low shipping prices to move their products rapidly from Chinese factories to US consumers.

As a result, DTC profits are vanishing, their stocks are taking a beating, and it’s unclear where it will end. Popular DTC brands like Allbirds, Hims and Hers, Peloton, Revolve, StitchFix, Warby Parker, and Wayfair have all reported significant losses in recent quarters and continue to have a negative outlook.

As of Monday, Allbirds dropped 64% in 2022. Stitch Fix and Warby Parker are down more than 40%. All other companies in the category are down at least 19% this year. These losses far outpace the performance of the S&P 500 which, by contrast, is only down 11% in a challenging year.

Brick and mortar makes a comeback

With challenging conditions in the e-commerce world, and as the demand for physical shopping has returned, many DTC online-only brands have turned to a new but old marketing strategy – a store where their customers can actually see the items in real time and outside of virtual reality.

DTC brands who had been experimenting with brick and mortar stores, like Warby Parker, began seeing a greater rise in success and foot traffic within their brick and mortar stores than ever before.

But while everything old might be new again, this physical retail trend for DTC brands does look different than previous arrangements. Newer retailers, especially digital native brands, often “don’t come from a bricks-and-mortar background and don’t want to commit to a long-term lease,” said Naveen Jaggi, the president of retail advisory services at JLL, the commercial real estate company. As a result, he said, property owners have had to become more flexible.

“The big trend line we have seen during the pandemic is that many landlords are starting to recognize that in order to attract different brands that can make their property stand out, they will have to go to shorter lease terms,” he said. (The New York Times)

In addition to shorter leases, some landlords are offering more generous tenant improvement allowances. And taking a percentage of store revenue in lieu of a fixed rent, while not a new strategy, has become more common. (The New York Times)

The bottom line: the new retail is a smart bet

The short-term commitment for brands new to brick and mortar retail, which can last from a few months up to one year, may result in the DTC brands opening a more permanent space, or it may show them that the customer exists elsewhere.

Regardless, owners of commercial retail spaces should be prepared to cycle through tenants more rapidly, and might be well advised to invest in flexible improvements or buildouts that could suit a variety of different brands.

It may seem ironic that brands who built their identity on new, online, and digital experiences are moving to a more traditional retail experience. But these commercial retail spaces are not your parents’ retail spaces – from flexible leases to incentives to quick moving pivots from online to offline and back again, there are many opportunities unfolding as the world is changing and evolving faster than ever before.

But with the right idea and makeup, a brick and mortar store may just be the saving grace for dying e-commerce brands – and a smart bet for savvy investors.

As always, our team of experts is on hand to assist with any commercial real estate appraisal needs you may have throughout the Los Angeles and Inland Empire. We appreciate the opportunity to serve you!

Request a Consultation

Valbridge welcomes single-property assignments as well as portfolio, multi-market and other bulk-property engagements.

By submitting my data I agree to be contacted